There have been several recent developments regarding the tax payable when UK property is purchased: Stamp Duty Land Tax, commonly referred to as SDLT.

SDLT Holiday

For residential properties, the 0% band has been increased to £500,000 from £125,000. This change is temporary and will end on 1 April 2021.

Buyers of second homes generally pay 3% more tax on each portion of the purchase price. That will continue, with the uplift in tax following the new rates.

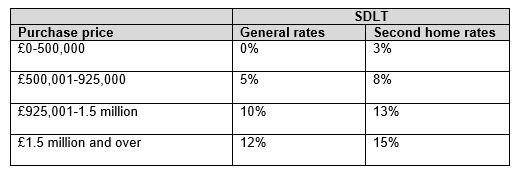

The new rates are as follows:

The new rates will not apply to non-residential property, which are chargeable at different rates. If land includes several residential properties, a saving may apply if a special relief can be used.

Main Home Replacement

As mentioned, buyers who own another home generally pay an additional 3%. However, if within three years of buying the new property they sell or gift their other home, they can reclaim the additional tax.

HMRC recently changed their published guidance to state that they will extend the three year deadline, if exceptional circumstances such as the coronavirus restrictions prevent a timely sale. The interruption must be sufficiently direct and each case will be assessed on its facts. The guidance suggests that an ongoing sale being delayed by restrictions might qualify. A mere decision not to sell due to a recession will not be sufficient.

Overseas buyers

The uplift of rates by 2% for buyers who are resident overseas will be introduced on 1 April 2021. The current rates will apply to certain transactions already underway shortly before then. Residence for this purpose will be different to residence for other taxes.

Comment

Saving some in the region of £4,375, the eye-catchingly named SDLT holiday will be positive news to buyers, even if it is the only holiday possible at the moment. As Matt Braithwaite touched on in his comments published in eprivateclient, the drop in rates across the board means that “winners” include those who own second homes; a welcome change from recent tax changes aimed at this group.

The similar coronavirus-related concession from HMRC for those selling additional homes will equally be welcome, although the requirement for a direct effect on a sale will mean that this will only apply in limited cases.

Increasing rates for overseas buyers seems at odds with the desire to boost activity in the housing market. Clients will be keeping an eye on values in Prime Central London, where over half of buyers in late 2019 were based overseas. The higher rates will coincide with the end of the SDLT holiday, meaning that overseas buyers will see a sharp increase in tax next April if they do not purchase before then. As an example, an overseas client who already owns a home purchasing a £2 million residential property would pay an additional £77,500, representing 4% of their investment.

As the latest raft of reforms render the taxation of residential property increasingly complex, it is more important than ever to take professional advice. Please contact Matt Braithwaite, Andrew McIntyre or your usual advisor if you have any queries in relation to the topics discussed in this article.