| Speed read: This article discusses gifts which oblige the recipient to leave the asset to another person on their own death. Those with these arrangements should seek UK advice, if the donor or recipient are resident in, or are originally from, the UK. |

Clients with assets in France, Italy or Spain may come across the following types of gift:

- donation graduelle;

- donation résiduelle;

- sostituzione fedecommissaria; or

- sustitución fideicomisaria.

How do these work?

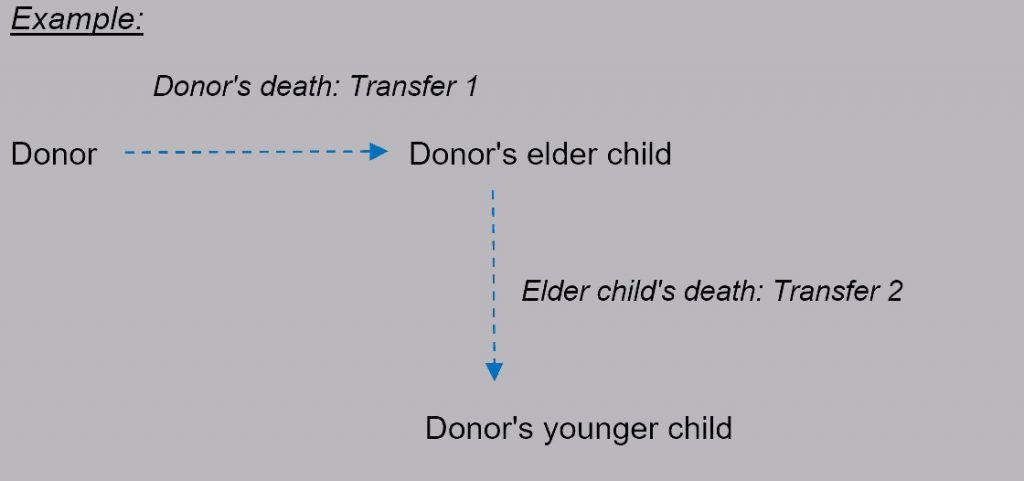

These are gifts to one recipient, with a secondary recipient who inherits on the first recipient’s death.

The advantages are:

- the donor can retain a degree of control lasting beyond their own lifetime;

- in some cases, the first recipient cannot sell or spend the asset; and

- in other cases, this provides a solution where the first recipient does not have sufficient mental capacity to make gifts themselves, e.g. in Italy.

Each country’s gift has different requirements. In France, these can be made during one’s lifetime or on death. In Italy and in most of Spain, they can only be made on death. Other civil law countries, such as in South and Central America, have similar concepts.

How are these taxed in the UK?

The UK tax treatment of these is uncertain. HMRC do not have a published view and there is a dearth of literature in the UK legal community.

As these types of gift do not exist in UK law, the tax system first looks for the closest equivalent concept which does exist in the UK. Once that equivalent is found, tax is then imposed (or not) accordingly.

UK equivalents

The “menu” of the most likely, amongst other, UK equivalents includes:

- life interest trust;

- disabled person’s trust; or

- outright gift.

Depending on the option above adopted, the tax treatment will vary.

Best case scenario

An outright gift classification is often be the best outcome for tax purposes, with the fewest preconditions to be satisfied. These are generally tax-free if the donor survives by 7 years. However, if the asset was standing at a gain, tax may have been due.

To obtain this tax treatment, legal arguments should be weighed up, based on the duties and obligations of the parties. If the first recipient can sell or spend the funds, that will be a favourable factor.

Worst case scenario

A life interest trust is where a person has a right to the income and use of an asset for their lifetime or a shorter period, with a default gift thereafter. This is superficially similar in its broad effect to the gifts discussed, but there are differences which we can highlight if instructed. If this equivalent applies, the UK tax consequences can be severe, applying: when the gift is made, every 10 years and when the donor dies.

For certain persons, particularly those originally from outside the UK, this classification may actually be tax-efficient.

Medium case scenario

A disabled person’s trust is, broadly, a trust which limits the amount payable to non-disabled persons. If the motive for the gift is to benefit a person lacking mental capacity, this tax treatment might well be possible. For tax purposes, such a classification would be broadly tax neutral, but would require the conditions to apply at all times.

Different UK taxes can be based on different UK equivalents. For example, a gift might be taxed as a life interest trust for Inheritance Tax, but as an outright gift for Capital Gains Tax.

What should I do if I have been recommended one of these gifts?

Depending on your personal position, some of the UK tax charges discussed above may not apply, and we can confirm if that is the case. The values in question and tax treaties may mean there is no tax, but the position should be checked.

We can examine the documents (even if in French, Spanish or Italian), set out the relevant law, and liaise with your local advisors, in order to come to a practical recommendation.

If the gift has not yet been made, we may be able to tailor the gift to meet the conditions in the UK and local country.

This article is for information purposes and should not be relied upon without further advice. We are only qualified to advise on the law of England and Wales. Any references to other laws are purely our understanding and should be checked with a local advisor.