Once a higher risk building is occupied, there are two main areas of the BSA that property investors should consider:

- the management of “building safety risks” and who is responsible; and

- the recovery of the costs of carrying out safety measures and remedial works.

We consider both in our series of articles concerning mixed use higher-risk buildings in England (Click here to view these articles) and this article focuses on the cost recovery.

NOT JUST ANY OLD STATUTE, THIS IS THE BSA

The BSA doesn’t just impose statutory obligations on Accountable Persons (“APs“) and Principle Accountable Persons (“PAPs“), it goes further and implies landlord covenants into leases of dwellings in higher-risk buildings (“HRBs“). All of these terms are explained in part 1.

The tenants of applicable residential leases have direct recourse as against their landlord for:

- a failure to comply with building safety duties under the BSA if the landlord is an AP; and/or

- a failure to cooperate with another AP who is complying with their building safety duties under the BSA; and/or

- a failure to include certain building safety information in demands for rent or service charge and to provide a tenant with certain notices containing building safety information to be given to the tenant.

These implied landlord covenants (and service charge recovery mechanism – see below) for HRBs cannot be excluded or limited and an agreement that imposes a penalty, disability or obligation on the tenant for enforcing them will be void.

COSTS OF BUILDING SAFETY MEASURES VERSES COSTS OF REMEDIATION WORKS

Any landlord of an HRB needs to know that the costs of “building safety measures” are treated very differently under the BSA to the costs of undertaking remediation works to “relevant defects” (such as the removal of unsafe cladding). The BSA implies into “relevant” leases of HRBs a service charge head of expenditure for the costs taking building safety measures only. The costs of the building safety measures should be apportioned using the same method that is used for apportioning the cost of insuring the building). The costs of complying with the duties relating to the ongoing management under part 4 are recoverable as service charge items in a relevant lease. Remediation works are the works needed to remedy historic defects in the construction of a building, the cost recovery of which is restricted.

WHAT IS A “RELEVANT” LEASE (“RL”)?

A RL is a lease in an HRB that was granted for a term of seven years or more (regardless of any potential for earlier termination) under which the tenant is liable to pay a service charge (pursuant to a residential lease under the Landlord and Tenant Act 1985). A flexible tenancy or an assured or assured shorthold tenancy of a dwelling in England granted by a private registered provider of social housing other than a long tenancy or a shared ownership lease will not be an RL.

SERVICE CHARGE RECOVERY GAPS

No one will forget the government’s announcement to:

“reset its approach to building safety with a bold new plan to protect leaseholders and make wealthy developers and companies pay to fix the cladding crisis.” (January 2022).

SO WHERE DID THINGS END UP?

In short, some residential leaseholders will pay nothing for remediation costs, some will pay a limited amount and others will pay the full amount of the costs. Some landlords will have to make contributions. Commercial tenants (such as retail or office tenants) who also occupy HRBs as part of a mixed-use building, don’t have the same protections as their fellow residential tenants.

Loading…

Loading…

THE HEADLINE GRABBER: “NO LEASEHOLDER LIVING IN THEIR OWN FLAT WILL HAVE TO PAY A PENNY TO FIX UNSAFE CLADDING”

Michael Gove gave this reassurance in January 2022 and he stood by his word. The BSA prohibits the costs of removing or replacing an unsafe cladding system being charged to certain residential tenants with a qualifying lease (see below). There are many tenants that don’t fall within those protections, such as commercial tenants, and there are many costs that relate to things wider than cladding.

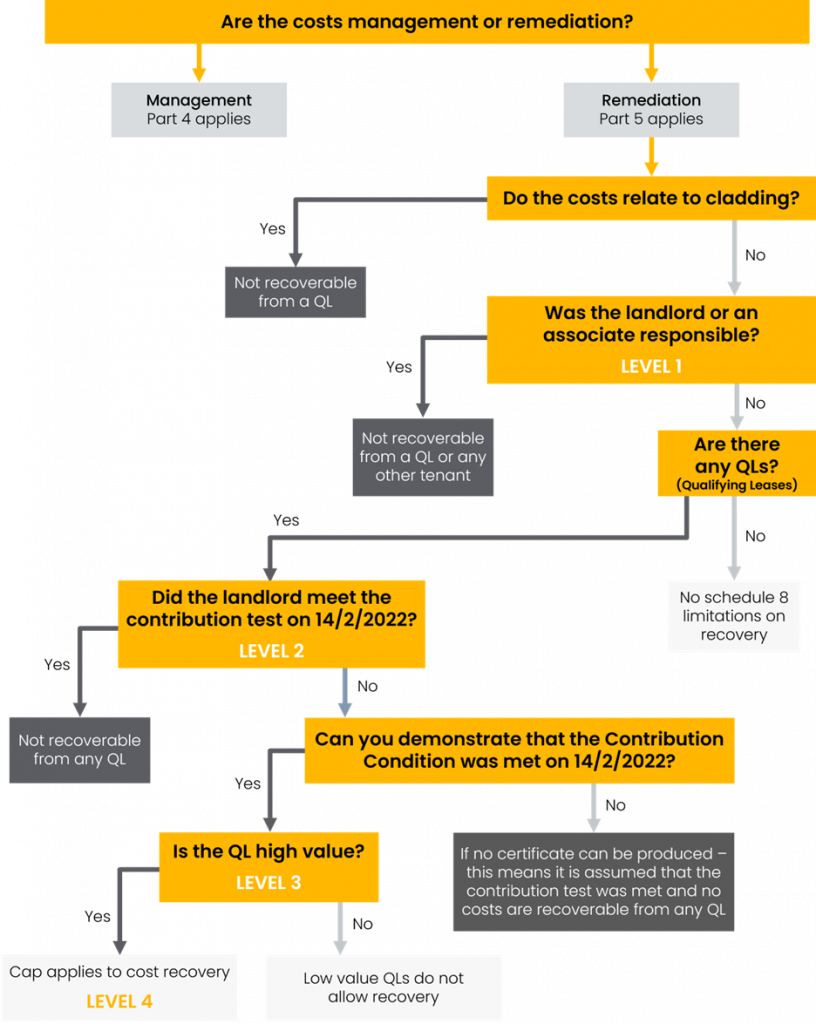

LEVEL 1, LEVEL 2, LEVEL 3 AND LEVEL 4 LEASEHOLDER PROTECTIONS

When it comes to service charge recovery for remediation works, there are yet more definitions that a landlord needs to be aware of. Where remediation works are needed to address a “relevant defect” in a “relevant building” there are restrictions on when and how much a landlord can charge costs to tenants via the service charge.

- Relevant building (“RB“): (in England) is a multi-storey residential or mixed-use building of at least 5 storeys or 11 metres which has at least two dwellings where the leaseholders do not have any interest in the freehold;

- Relevant defect (“RD“): broadly covers historical building safety defects which cause a building safety risk from the spread of fire or collapse of the building or part of it (this is distinctly different to the definition of building safety risk for the management obligations of part 4 of the BSA which refers to structural failure rather than collapse); and

- Qualifying lease (“QL“): a lease in an RB which meets all of the following criteria:

- of a single dwelling for a term of 21 years or more;

- requires payment of a service charge and the sum payable from time to time is not fixed (i.e. where the sum varies according to the actual cost of services);

- granted before 14 February 2022; and

- on 14 February 2022:

- the dwelling was a tenant’s only or principal home;

- the tenant did not own any other dwelling in the United Kingdom, or

- the tenant owned no more than two dwellings in the United Kingdom apart from their interest under the lease.

The leaseholder protections are multi-layered. To meet the government’s aim, landlords are deemed responsible for certain costs and other costs might pass down to tenants but subject to caveats:

- Level 1: landlords who are “responsible” for the RD are unable to recover any costs associated with RDs from any tenant (including commercial tenants). A landlord is responsible for an RD if it or a person associated with it (such as a group company) was the developer or commissioned or carried out the works relating to the defect;

- Level 2: landlords who are not responsible for the RD but deemed wealthy (i.e. they satisfy the “contribution condition”) are unable to recover any costs associated with RDs from leaseholders with QLs. The contribution condition is, broadly speaking, satisfied if on 14 February 2022 the landlord (or the landlord’s associates) had a net worth of more than £2,000,000 per RB). Landlords should note there is a presumption that a landlord meets the contribution condition unless a certificate provided to show otherwise;

- Level 3: landlords are unable to recover certain costs associated with a RD from leaseholders with QLs if the value of the QL on 14 February 2022 was less than £325,000 in London or £175,000 elsewhere; and

- Level 4: where a landlord has passed through levels 1-3, there is then a maximum sum that can be recovered by a landlord from a tenant with a QL.

The permitted maximum is £15,000 if the property is in Greater London, or £10,000 if the property is outside Greater London. However, the permitted maximum amounts are increased for higher-value properties (regardless of the location of the property). If the QL was worth between £1 million and £2 million on 14 February 2022, the permitted maximum is £50,000. If the QL was worth over £2 million on 14 February 2022 the permitted maximum is £100,000.

Given that levels 1-3 will have already passed through before level 4 is reached, the costs recoverable under level 4 will relate to non-cladding defects only. As well as future costs, costs that have already been charged or paid by a leaseholder of a QL in the five years prior to the 28 June 2022 will be included the permitted maximum.

In addition, there is a rolling limit of 10% of the permitted maximum that can be charged for remediation costs in any 12-month period. For example, if the permitted maximum is £10,000, the maximum amount payable towards remediation costs in a 12-month period is £1,000.

No service charge is payable under a QL in respect of legal or other professional services relating to the liability (or potential liability) of any person incurred as a result of a RD.

It is not possible to contract out of the level 1-4 protections. Any covenant or agreement that tries to exclude or limit them will be void.

TENANTS WITHOUT A QL

Many of the protections under part 5 only apply to RBs so if the building is less than 11 metres, none of the protections apply. However, none of the BSA obligations on a landlord will apply either but that doesn’t mean that landlords of non-RBs won’t be concerned about building safety and have some corresponding costs to pass on.

Whilst any tenant of an RB (including commercial tenants) can benefit from the level 1 protections, there won’t necessarily be a landlord or associated person who is “responsible” which will mean that some tenants will have remediation costs for RDs passed onto them.

Commercial tenants will not benefit from the level 2, 3 or 4 protections as they do not have a QL so they could be called upon to pay for costs associated with remediation of a RD (subject always to the terms of their individual leases).

However, commercial tenants and other residential tenants without a QL (such as those in shorter buildings or who had the lease granted after 14 February 2022) will not be liable for any shortfall in service charge that arises from a landlord’s inability to charge any costs to those that are within the level 1-4 protections. All of these tenants may be seeking express service charge exclusions.

In those cases where the cost of remediation works will fall on the residential leaseholders, the BSA inserts a new obligation on landlords into the Landlord and Tenant Act 1985 that requires the landlord to take reasonable steps to recover the costs through other avenues before including the costs in the service charge. Whilst this does not directly apply to commercial tenants, benefits are likely to pass onto commercial tenants indirectly as perhaps the overall service charge account will reduce given that the landlord will need to look into grants, funding and other third parties that are liable.

Levels 3 and 4 are not without criticism (not least because of the inequality in how a lease could fall in or out of the definition of a QL due to the status on the owner on 14 February 2022) but a line had to be drawn somewhere.

The part 4 management obligations arise by inserting implied covenants on a landlord to deal with management issues. The implied covenants do not apply to non RLs which means, the cost recovery mechanism is not implied either. This situation will apply to commercial leases. However, that doesn’t necessarily mean commercial tenants are not liable to pay for part 4 costs. It will depend on the terms of the lease as the lease drafting might be wide enough to include these safety management costs.

WHERE DOES THIS LEAVE YOU? THERE WILL BE IRRECOVERABLE COSTS BUT…

This note is a simplification of what is a significant piece of legislation with an abundance of regulations on implementation and government guidance notes. The BSA will need to be carefully analysed and applied to any building that could be within its scope. There are many detailed limitations and exemptions that this note doesn’t attempt to cover but could apply to your given situation. But the aim of the legislation is to pass building safety costs onto those who are considered to have deeper pockets rather than the person on the street. Landlords are highly likely to have to pay something for remediation and perhaps also management but we are here to help. We can help you navigate what it is you need to do and help you maximise the sums you are able to recover from tenants but perhaps also third parties. There might be claims a landlord can make against former landlords, other current landlords and contractors. Please get in touch with your usual Wedlake Bell contact. If your property is in Wales, please contact us for further information, as this note relates to buildings in England.

To view or download this article as a PDF, please click here.