The Government announced in November that it is reintroducing its controversial proposals to increase the costs of applying for grant of probate that they originally tried to get through Parliament in April 2017. Under the proposals, the maximum fee for applying for probate will rise from £155 to £6,000, an increase of 3,771%.

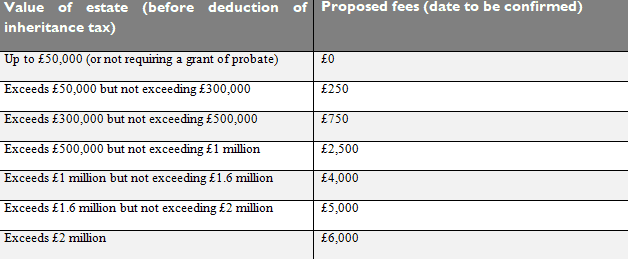

At present, the cost of applying for a grant of probate is a flat fee (£155 for an application through a solicitor; £215 for a personal application) and is not linked to the value of the estate. Under the proposed new regime, the fee will move to a banded system according to the net value of the deceased’s estate subject to the grant. The new fee bands are proposed as:

In an effort to ensure the proposals pass through Parliament and appease the many who opposed the divisive plans, the proposed fees have been reduced from that originally proposed, which would have seen a maximum fee of £20,000, but have nevertheless met with similar opposition amongst professionals and the public so far.

The Government’s principal reason for the new fee regime is to fund a large shortfall in the running of the court service in England and Wales. However, the Probate Registry is just one aspect of the court service and is self-funding: the cost of a probate application meets the cost of the service involved and no more. The Government consulted upon the original proposals and the unfairness of the situation was picked up in the 853 consultation responses (of which 695 were against increasing the fees in line with the size of the estate). Wedlake Bell responded on behalf of our clients and opposed the fee proposals.

The Government is not consulting on these new proposals and seemingly expects for them to be enacted. However, two Parliamentary Committees have criticised the proposals. The House of Lords Secondary Legislation Committee reported on 21 November 2018 that the fee bears no relationship to the actual cost of approving the probate application, “has the appearance of a tax” and is an “abuse of fee-levying power“. The Committee added: “In considering the policy the house may wish to bear in mind that those with higher value estates will already be contributing to the Exchequer through inheritance tax and stamp duty of up to 12% if a property is sold. It is also worth remembering that such estates are often divided between a number of beneficiaries, many of them charities.”

However, on 18 December 2018, the House of Lords voted in favour of the proposals by a narrow margin of 186 to 161 but included an amendment that puts on record the House’s regret that the proposed structure “represents a significant move away from the principle that fees for a public service should recover the cost of providing it and no more.” On 7 February 2019, the House of Commons delegated Legislation Committee also voted to approve the proposals, albeit by a narrow margin of nine votes to eight.

The legislation must now be approved by the House of Commons. The industry has been active in voicing its concerns and the Law Society is calling on members, and the wider public, to write to their MP to urge them to oppose the plans. You can send the Law Society suggested template letter to your local MP electronically here.

It remains to be seen whether this industry pressure, the House of Lords’ “regret motion”, along with the negative comments of the Parliamentary Committees, will put pressure on the Government to amend their plans. However, it looks likely that the Government will want to press ahead and clients should therefore be aware of the proposals and the possible impact on their estates. If enacted, it is expected that the new fees will take effect from April 2019.

This could mean that estates where the deceased died before April 2019 could be subject to the new fees if the application cannot be finalised and submitted before then. If confirmed, executors who are preparing an application for probate will need to act quickly so as to benefit from the fees at their current level.

We will update this article when there are further developments. If the proposals go ahead, clients whose estates exceed £2 million will need to start considering their options, including how their estate will fund the fee if applicable on death.

For more information on our probate and trust administration services, please click here.