In the context of financial remedy proceedings, in the absence of agreement as to the value of the parties’ assets, they must be valued. The reason for this, is that it is very difficult to negotiate a financial settlement (or for a Judge to determine a fair outcome) without knowing what there is in the “marital pot”. In this context, our clients are often faced with a situation whereby they, or their spouse, must have their interest in a business valued.

The most common method of valuing a trading business, is by looking at the company’s earnings and attempting to capitalise this value. This task must be undertaken by a suitable business valuation expert.

Using this method, in order to work out how much the company is worth, you must firstly calculate the maintainable earnings, usually by reference to its EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation). To do this, a business valuation expert will look at past profits, typically attributing greater significance to the most recent years of trading. They will also consider general trends in the company’s trading and future projections.

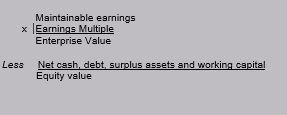

The company’s EBITDA is multiplied by an “Earnings Multiple” to provide the company’s “Enterprise Value”. The Earnings Multiple is a figure that would be decided upon by the business valuation expert, with reference to e.g. transaction and quoted company comparators, general indices and market specifics. Both the maintainable earnings figure and the appropriate Earnings Multiple are therefore open to interpretation by the expert.

The Enterprise Value is then adjusted in respect of the company’s net cash, debt, surplus assets and working capital.

The above can be summarised by the following calculation:

The Equity Value will of course need to be adjusted, in order that it reflects the size of the shareholding in question and may in fact be adjusted even further. For example, if a person has a minority shareholding in a business, it may appropriate to apply a discount.

The capital gains tax that would arise on a disposal of the interest in the business would also need to be considered in order to provide a net Equity Value. This is particularly important in the light of the fact that Entrepreneurs’ Relief became significantly less generous in March 2020.

Covid-19

The question we must then ask is, how might company valuations be affected by the uncertainties presented by the Coronavirus pandemic?

When looking at EBITDA, a company’s past performance may be less indicative of what it is likely to earn going forwards, in a Covid-19 landscape. Future forecasts may also be less reliable. We are still in the early days of the pandemic and in terms of the appropriate “Earnings Multiple”, there is currently a lack of data reflecting the impact of Covid-19. Therefore transaction comparators may also be less reliable. In addition, most companies will have been impacted in terms of their surplus cash and debt. Not only does this impact on value, but also the company’s liquidity. The company’s liquidity can be very important when we are looking at the option of extracting funds from a company to fund a financial settlement.

It is also important to recognise that whilst some companies might have been adversely affected by Covid-19, others may have increased their turnover, profits, and thus value.

For these reasons, it is incredibly important for the solicitors instructing the expert on a client’s behalf to consider the nature of their instructions. It may be appropriate to request that the expert provides two valuations, one on the basis of Business as Usual and one on a Covid-19 basis. Greater thought must also be given to the disclosure provided to the business valuation expert. For example, recent management accounts will be crucial in providing an up to date snapshot of performance following the outbreak of Coronavirus. Choosing the right expert, with relevant experience, is also key.

At the moment it is unknown how far into the future the impact of Covid-19 will be felt. On this basis, business valuations must proceed. It is clear, however, that in this context it is even more important than ever to secure expert legal advice in relation to these issues.