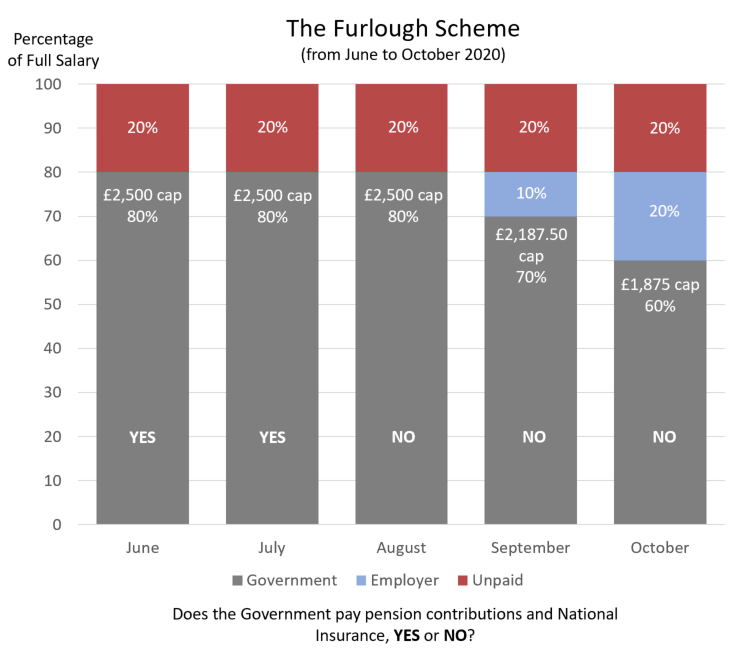

On 29 May 2020 the Chancellor announced that the Government’s Coronavirus Job Retention Scheme (the “Furlough Scheme”) would be changing to begin easing employees out of the Furlough Scheme.

From August 2020, a new tapering requirement means that employers will have to contribute towards their furloughed staff’s remuneration, beginning with the Government ceasing to pay any pension contributions and National Insurance. From September 2020, employers will have to pay 10% of furloughed employees’ salaries, rising to 20% from October 2020 and the salary cap will also reduce proportionately. It remains discretionary for employers to ‘top-up’ any part of an employee’s salary above 80%.

The changes to furlough will start to facilitate a return to work for some, but it also paves the way for redundancies for those businesses struggling to get back on their feet. For employers with final salary pension schemes, or hybrid schemes, there could be further consequences (even if the scheme has closed to accrual there could be consequences, for example, if there is final salary linkage).

We have already found with a number of our clients that furloughing a member of a final salary/defined benefit pension scheme can have drastic implications for retirement and death benefits due to the impact on members’ pensionable service and pensionable pay.

| Final Salary / Defined Benefit Schemes – How might furlough impact on the benefits payable from these schemes? There are a number of pensions issues that can arise from furloughing members of final salary schemes. The issues which arise, and the extent of those issues will depend on: • the wording of the employment contract; • the manner in which furlough has been implemented (e.g. has contractual basic pay been altered as a result of furlough?); and • the provisions of the scheme’s rules. The wording of the scheme’s rules and the interaction of those rules with the employee’s employment contract and the furlough arrangement may result in: • an automatic reduction to pensionable salary/pay; and/or • a member automatically ceasing to be in pensionable service. A reduction to automatic pay and/or a termination of pensionable service may impact on: • the continued accrual of benefits; • the level at which pension benefits accrue; • eligibility for death benefits; and • the level at which death benefits may be paid out. These consequences may cease to apply when furlough ends, but in many cases these consequences will have far-reaching impact, well into the future. Depending on the provisions in the scheme’s rules there are various ways to address these consequences if the employer’s intention is to ensure members suffer no detriment to their pension benefits as a result of being furloughed. We would strongly encourage trustees and employers take legal advice to determine how benefits might be impacted and to determine the best way to ensure their intentions are given effect to. |

We know many employers who offer money purchase/defined contribution pension benefits for their staff took necessary cost-cutting action by reducing contributions in light of Covid-19. Is now the time to revisit those changes?

| Money Purchase Schemes and Furlough If employers did not make any changes to their pension provision since Covid-19 reared its ugly head, but are now facing financial difficulties, they may wish to consider reducing contributions now. For those employers who did reduce contributions, if Covid-19 has not been as hard on their business as expected then these employers may wish to revert back to original contribution rates, or something in between (although it is perhaps early days for this kind of action). Employers need to remember the importance of communicating with their employees about any such changes, particularly important if those changes were said to be temporary. |

Employers should take note of the forthcoming changes to the Furlough Scheme and seek advice on how these changes might impact pension provision.

Employment costs are about to start increasing for those employers who have made use of the Furlough Scheme – they will have to start contributing more towards the Furlough Scheme – perhaps now is the time for these employers to look at how reviewing pension provision might offset some of these rising costs?

Our Pensions & Employee Benefits team is part of the People Services offering from Wedlake Bell. Together we provide a holistic approach and can advise you on all pension, employee benefit, employment and immigration issues which may arise in relation to furlough, Covid-19 and the difficulties they present. We can help with planning a strategy for dealing with the changes to the Furlough Scheme and with implementation including variations to employment contracts, making use of discretionary powers in scheme rules, and where necessary, amendments to scheme rules.