Have you filed your 2024 ROE update statement? What do the March 2024 ROE regulations mean for you? If you have real estate in Scotland, are you ready for 1 April 2024?

The ROE – one (and a bit) years on

As you may remember from our November 2022 briefing, the ROE is a government record of overseas entities that hold qualifying estates in UK land. Reportable entities are required to register with the UK Registrar of Companies (via Companies House) and to disclose required information about themselves, their registrable beneficial owners (“RBOs”) and managing officers. This information is generally publicly available; however, where a trustee of a trust is an RBO, information on the trust is currently not available to the public.

The Economic Crime and Corporate Transparency Act 2023 (“ECCTA 2023”) received Royal Assent on 26 October 2023. Part 3 of the ECCTA 2023 made various amendments to the ROE regime with the aim of:

- setting out new measures designed to close any loopholes in the original ROE legislation; and

- ultimately to give a more transparent and accurate overview of the beneficial ownership of UK land.

We discussed these amendments in our Globally Speaking interim update in December 2023 which you can read here.

Have you filed your 2024 ROE update statement?

Reportable overseas entities have an obligation to keep their registered information up to date and file update statements with Companies House at least annually. As entities were required to make their initial registration by 31 January 2023, many (notwithstanding some technical issues with the filing portal at Companies House) will have recently filed their 2024 update statement.

Have you filed yours? If not, let us know. Failure to do so is an offence by the entity and its officers and penalties may be issued.

Are you affected by the 4 March 2024 changes?

The amendments made to the ROE regime by the ECCTA 2023 required secondary legislation to bring them into force. On 4 March 2024, the first tranche of measures took effect pursuant to the (pithily named) Economic Crime and Corporate Transparency Act 2023 (Commencement No. 2 and Transitional Provision) Regulations 2024 (“the ECCTA regulations”).

The ECCTA regulations have made two key changes to the disclosure of trusts.

1. Disclosure of trustees as RBOs

Under the original ROE regime, if a trustee indirectly held a qualifying estate in UK land and there was an entity lower in its ownership chain which was “subject to its own disclosure requirements”, then information about the beneficial owners of the trust did not need to be disclosed for ROE purposes.

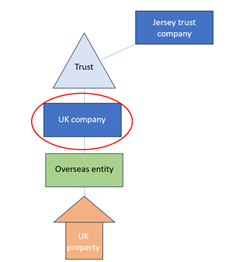

Illustration 1

By way of example, in illustration 1 above, the RBO of the overseas entity would have been the UK company. This was on the basis that the UK company is a legal entity subject to its own disclosure requirements (under the UK’s register of people with significant control (“PSC”)). No disclosure of the trust was required. This was the case even though the PSC register did not require disclosure of any information about the trust.

Since 4 March 2024, a legal entity will be identified as the RBO of an overseas entity if it is (a) a beneficial owner of the overseas entity; (b) either subject to its own disclosure requirements or a beneficial owner by virtue of being a trustee; and (c) not exempt from registration. Under the new rules:

- overseas entities must identify all trustees in their chain of ownership and report them as RBOs. In the above example, the trustee of the overlaying trust will be an RBO of the overseas entity and will, in turn, need to disclose reportable information about the trust; and

- there is no requirement for trustees to be regulated which will bring some private trust companies within scope of ROE disclosure for the first time.

Entities affected by these new rules will benefit from a transitional provision in respect of timescales for updating their reportable information on the ROE, as the new rule will only apply from the occasion of their first updating duty after 4 June 2024. This gives structures affected by the new rule time to gather the required information.

2. Nominees

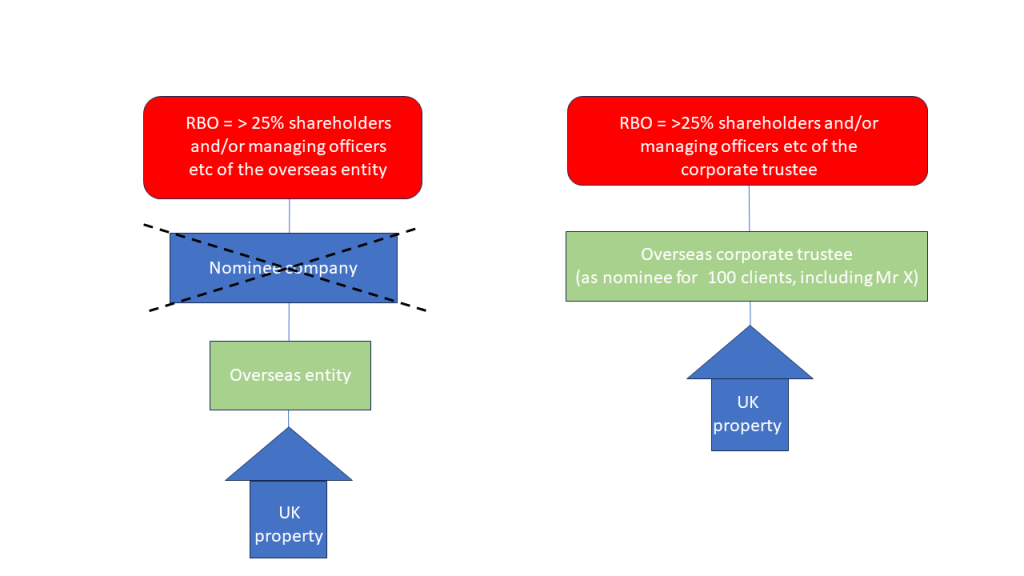

Nominee arrangements in the chain of ownership of an overseas entity are, and will continue to be, “looked through” for the purpose of establishing the RBO of an overseas entity as per illustration 2 below.

However, where an overseas entity is a corporate trustee acting as nominee (particularly in respect of multiple nomineeships) as per illustration 3 below, under the original ROE regime the disclosable RBO was normally the beneficial owner of the trust company, not the ultimate beneficiary of the nominee arrangements. This meant that no information about the nomineeship or the ultimate beneficial owner of the land was disclosed for ROE purposes.

Illustration 2 Illustration 3

This lacuna in the legislation has now been closed and, since 4 March 2024, the definition of “RBO” has been expanded to include a new condition relating to nominees. Registered overseas entities acting as nominee will now need to update their ROE filings and disclose the ultimate beneficial owner under each of the nomineeship arrangements involving qualifying estates in UK land which the corporate trustee administers.

For overseas entities that had registered and been allocated an overseas entity ID before 4 March 2024, this new rule will apply from the occasion of the entity’s first updating duty after 4 June 2024. For example, if an entity is due to update its reportable information by 1 May 2024, its 2024 update statement will be made under the existing rules. Only update statements due in after 4 June 2025 and subsequent years will be affected.

Other measures introduced by the ECCTA regulations are largely administrative, but nonetheless important, particularly in light of the modified and wide range of offences and penalties for failure to fully comply with ROE reporting.

Of the administrative measures, it is particularly worth noting that entities that are required to disclose an address under the ROE rules, may no longer provide a registered office address. Instead, only the principal office address will be accepted and this change takes effect immediately. This means that when filing an update statement (or on an application to remove an entity from the ROE register), overseas entities will need to check which address has been provided previously and, if necessary, update their address information.

Are any further changes expected?

The remaining measures under Part 3 of the ECCTA 2023 are expected to be implemented this year, although no fixed timeframe has been given. The awaited regulations will make further significant changes to the ROE regime, including introducing the following.

1. Greater access to trust information

The new rules are expected to enable applications to be made by third parties for access to currently unpublished trust information in certain circumstances. Notably, it is proposed that individuals seeking information about a particular trust will not need to prove a public or legitimate interest (although they will be required to explain how they intend to use the information). Only if an applicant wishes to request information about more than one trust, will they be required to provide evidence that they have a legitimate interest in accessing the information.

In the recent case of WM and Sovim SA v Luxembourg Business Registers (C‑37/20 and C‑601/20) in the Court of Justice of the EU, unfettered public access to a Luxembourg beneficial ownership register was held to be contrary to EU law. While that decision is not binding in the UK, there is a risk of a similar challenge being made in the UK on the grounds that allowing public access to ROE trust information without a legitimate interest hurdle is a disproportionate infringement of the right to privacy as enshrined in the UK Human Rights Act 1998.

The government has recently consulted on other potential steps to increase the transparency of UK land ownership and of the trust information held on the ROE (as explained below). Although the government stressed that these steps are in addition to the ECCTA 2023 measures for greater access to trust information, it seems likely that the consultation may affect how and when the ECCTA 2023 measures are brought into force.

2. Wider “protection” regime

The “protection” regime enabling individuals connected with trusts to apply for their information to be protected from public disclosure is being expanded. Currently, information is only protected if there is a risk of intimidation or violence, but it is thought that vulnerable beneficiaries will be able to apply for their information to be protected under the new regulations. The new protection regime is likely to be of increasing significance given the proposed widening of access to trust information (see above).

3. Reporting and identifying UK land held by the overseas entity

All reportable overseas entities will need to provide the Land Registry title number of their qualifying estate(s) in UK land. This measure will go some way to linking the information held on the Land Registry and that held by Companies House, and to achieving the government’s aim of transparency of land ownership, although the title numbers are not expected to be made publicly available.

4. Changes to beneficiaries of trusts

Where a trustee is an RBO of a registered overseas entity, information about persons who have become, or who have ceased to be, beneficiaries of the relevant trust (save in respect of pension scheme trusts) will need to be disclosed by the entity as part of its updating duty and on any application for removal from the register.

5. Notices for former RBOs

All reportable overseas entities will be under a new obligation to provide an additional notice to any person who has ceased to be an RBO (during the update period and on any application for removal from the register) and former RBOs will have an obligation to comply with such notices.

6. Changes to beneficial ownership during the ROE transition period

Currently, only RBOs at the date of an overseas entity’s first registration need to be identified; however, new regulations are expected to require changes to the beneficial ownership of an overseas entity made during the ROE transition period (28 February 2022 to 31 January 2023) to become reportable. This means that entities that re-organised their beneficial ownership during the transition period to avoid reporting certain RBOs, will now need to disclose them. For example, if a trust protector or other party released powers of control during the transition period, such persons may need to be reported to Companies House once this measure has become effective.

7. Changes to verification

New rules on how information is to be verified and new offences for failure to comply with verification requirements are expected to be introduced. This will be relevant for regulated verification agents and may affect the information that needs to be requested from overseas entities when registering them on the ROE, submitting update statements or assisting with their removal from the register.

Government consultation on the transparency of land ownership

In a recent government consultation (jointly launched by the Department for Levelling Up, Housing and Communities, the Treasury, HM Revenue and Customs (“HMRC”), and the Department for Business and Trade), the government sought views on other potential steps to increase the transparency of UK land ownership and trust information held on the ROE.

The government’s case for change to the transparency of UK land ownership is based on three overriding principles, namely that:

- greater transparency of land ownership where trusts are involved is a matter of legitimate public interest enabling the government to monitor land use and more effectively police misuse of land. The consultation refers to an “unquestionable” public interest in knowing who really owns land and property;

- it may help address issues in the housing sector such as: identifying landlords so that potential tenants/buyers can approach them more easily; allowing historical remediation costs for high rise buildings (e.g. cladding issues) to be resolved; or better enabling enforcement against rogue landlords; and

- it may help tackle illicit finance and corruption; offshore structures holding UK property having been identified by the National Risk Assessment 2020 as posing a higher risk of money laundering.

While we support transparency to tackle money laundering and other financial crimes, we question whether making trust information publicly available would in fact achieve the government’s objectives, particularly since much of the relevant information is already available to law enforcement, HMRC and public authorities in any event. In particular, it is difficult to see how making information about discretionary beneficiaries (who have no right to benefit from, and no power to control, trust property) could do so. Trusts are legitimately used by individuals and families for many lawful purposes. Making all trust information public risks infringing beneficiaries’ rights to privacy and putting young and vulnerable beneficiaries at risk by making them vulnerable to extortion, for example. The balance between the competing issues of transparency, proportionality, human rights and public safety is a difficult one to strike, and it will be interesting to see how the government responds.

A note on Scottish land ownership

Finally, it is worth noting that Scotland introduced a Register of Controlling Interests in Scottish land (“RCI”) in 2022. The deadline for first registrations is 1 April 2024. If you are the owner or tenant of land in Scotland, you may need to register on the RCI in addition to the ROE before this deadline. There are criminal sanctions and fines of up to £5,000 for non-compliance.

If you need assistance with any of the issues discussed in this article, please get in touch with us.