From 6 April 2013, a statutory residence test has applied in the UK. The test determines liability to UK income tax, capital gains tax and (in some cases) inheritance tax for those coming to, or leaving, the UK. Individuals who expect to spend some time in the UK during the course of the UK tax year (6 April to 5 April) should check whether the test will affect them.

Background

Prior to 6 April 2013, UK law on residence had been based on a mixture of case-law, statutory provisions and unbinding guidance from H.M. Revenue & Customs. The statutory residence test provides a written test that tax-payers can use to determine their residence status with reasonable certainty. It replaces all previous law and guidance for tax years 2013/14 onwards.

Overview of the residence test

The statutory residence test consists of three separate tests:-

- an automatic overseas test;

- an automatic UK test; and

- a “sufficient ties” test.

If you satisfy the automatic overseas test, you will be classified as non-UK resident. Otherwise, you will need to look at the second two tests and if you satisfy either one, you will be regarded as resident in the UK for tax purposes.

Automatic overseas test

You will be classified as non-UK resident in a relevant tax year if any of the following apply:-

- you were resident in the UK for one or more of the previous three tax years and spend fewer than 16 days in the UK in the relevant tax year;

- you were resident in the UK for none of the previous three tax years and spend fewer than 46 days in the relevant tax year; or

- you work full-time overseas over the relevant tax year without any significant breaks and spend fewer than 91 days in the UK of which fewer than 31 days are working days.

There are two further tests that apply to determine a deceased individual’s tax liability and there are particular definitions for what constitutes a “day spent in the UK”, a “working day” and “significant breaks”. Note that days spent in the UK in transit can count as a day of UK residence in certain circumstances; one example being if you engage (even to just a minor extent) in a work-related activity, such as sending a message on social media for work purposes.

Automatic UK test

You will be classified as UK resident in a relevant tax year if any of the following apply:-

- you spend 183 days or more in the UK in the relevant tax year;

- there is at least one period of 91 consecutive days, at least 30 of which fall in the relevant tax year, when you have a home in the UK in which you spend a sufficient amount of time and you either have no overseas home or spend no more than a permitted amount of time in it; or

- you work full-time in the UK for 365 days or more with no significant breaks, all or part of that 365-day period falls within the relevant tax year, more than 75% of the total number of days in the 365-day period that are working days, are working days spent in the UK, and at least one day which is both in the 365-day period and in the relevant tax year is a day on which you do more than three hours work in the UK.

The above three tests also apply to deceased individuals along with an additional fourth test. There are particular definitions for “sufficient amount of time” and “permitted amount of time”. “Home” has no statutory definition so care must be taken that any place you use when in the UK cannot be classified as such. The guidance available suggests that genuine holiday homes and temporary retreats will not be caught but this is subject to conditions.

Sufficient ties test

This test looks at your ties to the UK. These are listed below.

- Family tie: your spouse, civil partner, cohabiting partner or minor child is UK resident in the relevant tax year. There are exceptions for minor children who are in the UK for full-time education or who you visit in the UK on fewer than 61 days.

- Accommodation tie: you have accommodation available to you for a continuous period of 91 days or more during the relevant tax year and you spend one or more night there (or 16 or more nights if the accommodation is that of a close relative).

- Work tie: you do more than three hours work a day in the UK for at least 40 days in the relevant tax year.

- 90 day tie: you spend more than 90 days in the UK in either or both of the previous two tax years.

- Country tie: the UK is the country in which you are present at midnight for the greatest number of days in the relevant tax year. This tie only applies if you are resident in the UK for one or more of the previous three tax years (a “recent UK resident”).

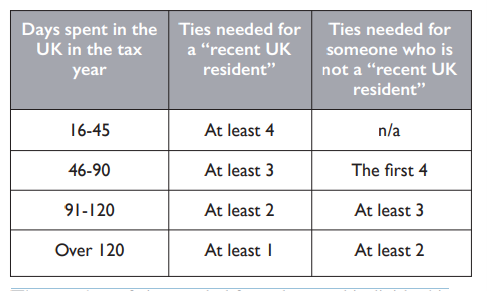

The number of “ties” that are sufficient to make you UK resident depends upon whether you are a “recent UK resident” and how many days you have spent in the UK. The table below shows how many ties will be sufficient to establish UK residency in any of the given periods:-

The number of ties needed for a deceased individual is calculated differently.

Split year treatment

The general rule is that if you are UK resident under the statutory residence test for any part of the tax year, you are classified as UK resident for the whole of it. However, a tax year can be split into two parts – a “UK part” (where you are treated as UK resident for tax purposes) and an “overseas part” (where you are treated as non-UK resident for tax purposes) – if certain criteria apply. There are eight different criteria and these are available to those leaving the UK and those arriving. For example, those leaving the UK to take up full-time work overseas and those arriving in the UK who start to have a home here could qualify for the concessionary treatment (subject to conditions).

Comment

The statutory residence test is not a straightforward arithmetical day-counting test and the multifaceted nature of the test does mean that advice will be needed in many cases. If you believe yourself to be non-UK resident but expect to spend some time in the UK in the current tax year, you should consider how the residency rules will impact you. We are happy to help in interpreting and applying the residence rules to your particular circumstances.